Brazil & Taiwan at a glance

Grow Faster. Expand Smarter. Tap Brazil from Taiwan.

Explore how Brazil’s dynamic market conditions compare with Taiwan’s mature economy. Understand key indicators that matter when expanding operations overseas. Discover why Brazilian growth, demographics and innovation incentives complement Taiwanese strengths. Evaluate costs, timelines and compliance nuances. Build a confident go-to-market plan backed by data.

Economy

Key Economic Signals for Strategic Entry

Compare growth, stability and purchasing power before choosing your next investment destination. See how Taiwan’s numbers stack up against Brazil’s vibrant market trajectory below.

Taiwan Economic Indicators

Country | GDP per capita (PPP, US$) | Real GDP growth 2025 (%) | Inflation 2024 (%) | Unemployment 2023 (%) |

|---|---|---|---|---|

Brazil | 10816 | 2.2 | 4.83 | 7.95 |

Taiwan | 34924 | 2.7 | 1.7 | 3.73 |

Opening a Company: Compare the Hurdles

Understand incorporation steps, costs and investor protection in Taiwan versus Brazil so you can structure the most efficient market entry.

Taiwan Business Setup Metrics

Country | Procedures to start a company (number) | Average time to incorporate (days) | Incorporation cost (% of income per capita) | Minority‑investor protection index (0‑10) | Tax payments per year (number) |

|---|---|---|---|---|---|

Brazil | 11 | 17 | 4.8 | 6.5 | 9 |

Taiwan | 3 | 17 | 3.7 | 6.5 | 9 |

FEATURES

Create your own unique website & have fun doing it!

UDesign was released more than 10 years ago.

And it is a very powerful theme which suits both users with no programming background as well as professional web designers.

Today's States

Country | Currency | Price | Volume ( 24h ) | Change |

|---|---|---|---|---|

Bitcoin | BTC - USD | $9780 | $368,645,000 | +4.8% |

Ethereum | ETH - USD | $305 | $224,180,000 | -3.2% |

Litecoin | BTC - USD | $80 | $283,573,000 | +2.2% |

dignissimos ducimus qui blanditiis

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aliquam imperdiet id lorem in ullamcorper. Integer pharetra efficitur ipsum a volutpat. Fusce quis ultrices eros, eget venenatis ipsum. Integer orci neque, venenatis id diam at, tempus semper nulla. Pellentesque suscipit nulla quis orci tempus feugiat id nec nunc. eus in fermentum.

Today's States

Name | Currency | Price | Volume ( 24h ) | Change |

|---|---|---|---|---|

Bitcoin | BTC - USD | $9780 | $368,645,000 | +4.8% |

Ethereum | ETH - USD | $305 | $224,180,000 | -3.2% |

Litecoin | BTC - USD | $80 | $283,573,000 | +2.2% |

Name | Brazil | Taiwan |

|---|---|---|

Max legal working hours (h/week) | BTC - USD | $305 |

Statutory paid annual leave (days) | ETH - USD | $305 |

Min. dismissal notice (days) | BTC - USD | $80 |

Severance pay /year of service (mo.) | BTC - USD | $80 |

Maternity leave (wks, % pay) | BTC - USD | $80 |

Minimum paid vacation days by law | BTC - USD | $80 |

Public paid holidays per year | BTC - USD | $80 |

Sick leave: duration & wage replacement | BTC - USD | $80 |

Sick leave: duration & wage replacement | BTC - USD | $80 |

Parental leave: weeks & pay | BTC - USD | $80 |

Employer social-security contribution rate (% of payroll) | BTC - USD | $80 |

Employer of Record (EOR)

Hire Brazilian talent quickly without opening a legal entity and remain 100% compliant.

Read MoreProfessional Employer Organization (PEO)

Co-employ your Brazilian workforce while Wide Brazil manages HR, benefits and local obligations.

Read MorePayroll Outsourcing

Ensure accurate, on-time salaries and tax filings for your Brazilian staff every month.

Read MoreCompliance Advisory

Stay ahead of Brazil’s fast-changing labor and tax regulations with expert legal guidance.

Read MoreComplete your expansion toolkit

See how Wide Brazil supports every growth stage

Our bilingual specialists streamline compliance, staffing and payroll for Taiwanese firms entering Brazil. Explore the solutions below to accelerate market success with full confidence.

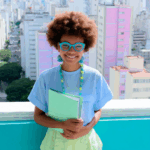

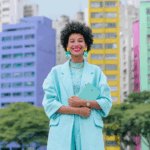

Testimonials

Graça BullaraHR Manager, AverisPartnering with Wide Brazil has been instrumental in launching our operations in Brazil. Their unparalleled services, considered the best in the country, have enabled us to swiftly onboard new staff. The lightning-fast and comprehensive support they provide has ensured a seamless transition, empowering our success in hiring and expanding. A decision we celebrate every day!

Thomás Della TorreGlobal Recruiter, Blue PremiumWorking with Wide Brazil has been a game-changer for our recruitment agency. Their exceptional services, by far the best in Brazil, come at a great price. We're thrilled by their lightning-fast onboarding process and unparalleled support, which have truly elevated our recruitment efforts. A partnership that's redefined our standards!

Confidential ClientGlobal EOR FirmOpting for Wide Brazil proved instrumental in our global EOR endeavors. Their exceptional services streamlined the onboarding of our new workforce in Brazil, while their unwavering support made navigating complex regulations remarkably straightforward. The team’s dedication and expertise transformed our expansion into the Brazilian market into a remarkably hassle-free experience!

Frequently Asked Questions

Below you will find concise answers to the most common topics we discuss with Taiwanese executives.

- Hiring Compliance

- Payroll & Taxes

- Talent Availability

How fast can Wide Brazil onboard our Taiwanese staff in Brazil?

With EOR or PEO structures we typically onboard professionals within 10 business days after receiving complete documentation, covering contracts, tax registrations and mandatory benefits.

Do we need to open a legal entity to pay employees?

No. Through our Employer of Record service Wide Brazil becomes the local employer of record, so you can run Brazilian payroll without establishing a subsidiary.

How does Brazilian payroll differ from Taiwanese payroll?

Brazilian payroll includes 13th salary, mandatory vacation premium and higher social-security charges. Wide Brazil calculates all extras and files required reports for you.

Can you support compliance in multiple Brazilian states?

Yes. Our specialists manage labor and tax nuances across all 26 states and the Federal District, ensuring compliant operations wherever your team is based.