REAL COST AWARENESS

WELCOME TO WIDE BRAZIL

Reveal Hidden Payroll Costs and Protect Your Budget

Discover every statutory charge and perk before you sign an employment contract in Brazil. Avoid surprises and plan with confidence.

How We Calculate Your Total Cost

Our five-step methodology gives you a crystal-clear view of every expense line, from base salary to last-mile perks.

1. Salary Benchmark

We start by mapping market salaries for each role so you see the baseline.

2. Tax Simulation

Employer taxes and social contributions are modelled on real-time rates.

3. Benefits Projection

FGTS, vacation, 13th salary and statutory allowances are automatically included.

4. Inflation Adjustment

We apply indexation and currency fluctuation factors to keep numbers current.

5. Final Cost Report

Receive a detailed spreadsheet ready for board approval and budgeting.

TRANSPARENCY

Key Advantages of Our Simulator

Full Cost Visibility

See the exact employer burden expressed in BRL, USD or EUR for instant comparison.

Compliance Assurance

Every figure complies with current Brazilian labor legislation, giving you legal peace of mind.

Scenario Modelling

Tweak salary, benefits, and headcount to watch totals update in real time.

Brazil Hiring Snapshot

Get a clear outline of salaries, taxes, and benefits to guide informed hiring choices in the Brazilian market.

Four Simple Steps To Clarity

Cost Intelligence Roadmap

Step 1

Share Role Details

Provide position, seniority, location and currency preference.

Step 2

Receive Estimate

We deliver an itemized cost projection within 24 hours.

Step 3

Review Compliance

A specialist explains taxes, benefits, and deadlines in plain language.

Step 4

Finalize Budget

Approve figures and we assist with hiring or payroll setup.

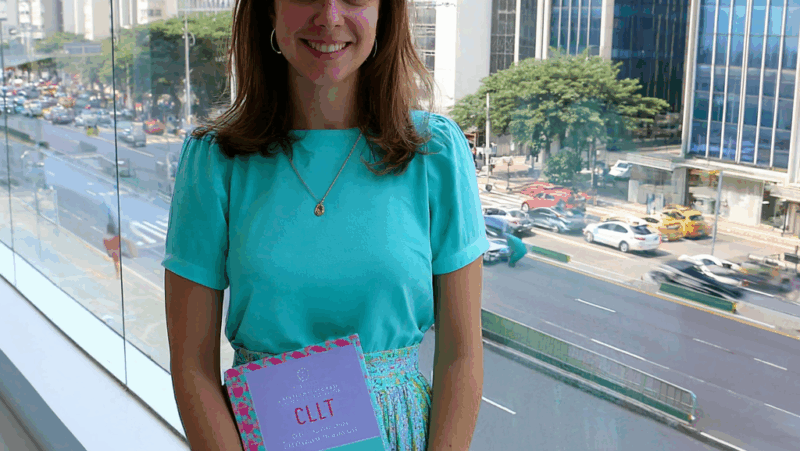

ABOUT US

Experts Inn Brazilian Employment Costs

Since 2011, Wide Brazil has guided multinational companies through the financial maze of local workforce regulations.

10

YEARS IN PAYROLL

Continuous dedication to accuracy and client success.

Testimonials

Graça BullaraHR Manager, AverisPartnering with Wide Brazil has been instrumental in launching our operations in Brazil. Their unparalleled services, considered the best in the country, have enabled us to swiftly onboard new staff. The lightning-fast and comprehensive support they provide has ensured a seamless transition, empowering our success in hiring and expanding. A decision we celebrate every day!

Thomás Della TorreGlobal Recruiter, Blue PremiumWorking with Wide Brazil has been a game-changer for our recruitment agency. Their exceptional services, by far the best in Brazil, come at a great price. We're thrilled by their lightning-fast onboarding process and unparalleled support, which have truly elevated our recruitment efforts. A partnership that's redefined our standards!

Confidential ClientGlobal EOR FirmOpting for Wide Brazil proved instrumental in our global EOR endeavors. Their exceptional services streamlined the onboarding of our new workforce in Brazil, while their unwavering support made navigating complex regulations remarkably straightforward. The team’s dedication and expertise transformed our expansion into the Brazilian market into a remarkably hassle-free experience!

Employer of Record (EOR)

Hire quickly with Wide Brazil as legal employer while we handle compliance.

Read MorePayroll Management

Delegate Brazilian payroll processing and statutory filings to our local team.

Read MoreCompliance Advisory

Stay ahead of regulatory changes with proactive legal monitoring and guidance.

Read MoreExplore Related Services

Build A Complete Employment Strategy

Combine our cost insights with operational solutions to onboard, pay, and manage talent in Brazil without friction.

Need clarifications?

All figures are gross employer expenses.

- All figures are gross employer expenses.

- Calculator updates automatically with legal changes.

- Contact us for custom multicurrency reports.

What taxes must Brazilian employers pay in addition to salary?

Employers contribute INSS, FGTS, RAT, and, depending on industry, additional levies like SENAI and SEBRAE, all calculated on gross payroll.

Is FGTS calculated on bonuses?

Yes. FGTS applies to regular salary, the 13th salary, vacation payments, and most performance bonuses unless specifically exempted.

How does the 13th salary work?

It is a mandatory extra month of salary paid in two installments: between February–November and by 20 December, increasing total annual cost by roughly 8.33%.

Can Wide Brazil manage payroll after cost calculation?

Absolutely. Once your budget is approved, we can provide full payroll outsourcing or Employer of Record services.

Recent Posts

Nunc id cursus metus aliquam. Aliquam id diam maecenas ultricies mi eget mauris. Volutpat ac tincidunt vitae.

u003ci class='a-icon-heart'u003eu003c/iu003e 0 Like Post

Brazilian employer compliance is one of the most daunting challenges faced by foreign founders and HR consultants seeking to establish or expand operations in Brazil. From the intricate Consolidação das…

Brazilian employer compliance is one of the most daunting challenges faced by foreign founders…