TACKLE YOUR PAYROLL PAIN

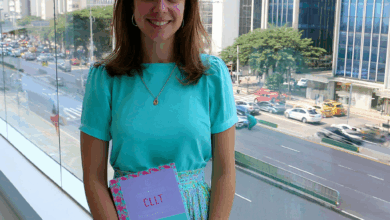

WELCOME TO WIDE BRAZIL

Pay Brazilian Staff Precisely. Compliantly. Every Single Time.

Discover how to calculate wages, statutory charges and benefits so your Brazilian payroll is 100% accurate and penalty-proof.

Our Proven Payroll Accuracy Workflow

From data gathering to final pay slip, each step safeguards compliance with Brazilian labor law.

1. Data Collection

We capture employment details, contracts and benefit rules straight from your HR systems.

2. Validation

Our specialists audit information to catch missing fields, outdated rates or misclassified workers.

3. Calculations

Automated engines compute wages, taxes, social contributions and mandatory benefits.

4. Review & Approval

You receive a draft payroll to approve or request adjustments before cutoff.

5. Filing & Payment

We file e-Social, issue payslips, and release salaries on the agreed date.

RELIABILITY

Why Companies Trust Our Payroll Team

Zero Penalties

Our compliance experts keep you clear of costly fines and audits.

Transparent Costs

Know every labor charge before payday—no surprises.

Employee Trust

Accurate, on-time payslips boost morale and retention.

Time Saved

Free your HR team from spreadsheets and manual updates.

Steps to Error-Free Payroll in Brazil

Our transparent 4-stage approach

STEP 01

Gather Documents

Collect contracts, benefits policies and time records.

STEP 02

Calculate & Audit

Run automated calculations and cross-check statutory tables.

STEP 03

Approve & Sign

Managers approve payroll and authorize filings.

STEP 04

Pay & Report

We disburse salaries and submit government reports.

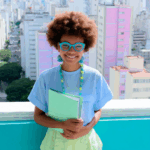

ABOUT WIDE BRAZIL

Driven By Compliance, Powered By People

Since our first pay slip, we have helped global companies compensate Brazilian talent with total confidence.

10

YEARS PAYING STAFF

Consistently accurate payroll cycles delivered

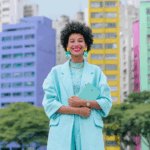

Testimonials

Graça BullaraHR Manager, AverisPartnering with Wide Brazil has been instrumental in launching our operations in Brazil. Their unparalleled services, considered the best in the country, have enabled us to swiftly onboard new staff. The lightning-fast and comprehensive support they provide has ensured a seamless transition, empowering our success in hiring and expanding. A decision we celebrate every day!

Thomás Della TorreGlobal Recruiter, Blue PremiumWorking with Wide Brazil has been a game-changer for our recruitment agency. Their exceptional services, by far the best in Brazil, come at a great price. We're thrilled by their lightning-fast onboarding process and unparalleled support, which have truly elevated our recruitment efforts. A partnership that's redefined our standards!

Confidential ClientGlobal EOR FirmOpting for Wide Brazil proved instrumental in our global EOR endeavors. Their exceptional services streamlined the onboarding of our new workforce in Brazil, while their unwavering support made navigating complex regulations remarkably straightforward. The team’s dedication and expertise transformed our expansion into the Brazilian market into a remarkably hassle-free experience!

Employer of Record (EOR)

Hire in Brazil without opening a local entity; we become the legal employer.

Read MoreCompliance Advisory

Stay updated with ever-changing Brazilian labor legislation and tax rules.

Read MoreEmployment Onboarding

Smoothly integrate new hires with mandatory registrations and orientation packs.

Read MoreComplete Your People Operations

Explore More Ways We Help You Succeed

Our specialists can manage every stage of employment, so you stay focused on growing your business.

Still have questions about Brazilian payroll?

Comprehensive support

- Comprehensive support

- Full compliance

- Transparent pricing

What taxes must be withheld from Brazilian salaries?

Employers must deduct INSS, FGTS, and IRRF according to each employee’s bracket and remit them to the authorities.

How long does payroll implementation take?

Typical onboarding takes 2-4 weeks, including data migration, system setup and first test run.

Can you calculate 13th salary and vacation pay?

Yes. Our platform automatically prorates and schedules both mandatory benefits, reflecting them on payslips and ledgers.

Do you integrate with international HR platforms?

We offer API and flat-file integrations with popular global HRIS systems, ensuring seamless data flow.

Recent Posts

Nunc id cursus metus aliquam. Aliquam id diam maecenas ultricies mi eget mauris. Volutpat ac tincidunt vitae.

u003ci class='a-icon-heart'u003eu003c/iu003e 0 Like Post

Brazilian employer compliance is one of the most daunting challenges faced by foreign founders and HR consultants seeking to establish or expand operations in Brazil. From the intricate Consolidação das…

Brazilian employer compliance is one of the most daunting challenges faced by foreign founders…