TAX COMPLEXITIES

WELCOME TO WIDE BRAZIL

Navigate. Comply. Thrive.

Brazilian payroll taxes do not need to be a maze. Let our experts transform mandatory deductions, ancillary filings, and e-Social uploads into predictable, worry-free routines.

Our Proven Compliance Process

Every engagement follows a transparent five-step methodology that removes guesswork and keeps you audit-ready.

1. Discovery

We map your current payroll flows, collective agreements and tax registrations.

2. Gap Review

Our specialists identify missing certificates, rates and social-security codes.

3. Setup & Testing

We configure systems, run shadow calculations and validate payslips end-to-end.

4. Live Filing

Timely e-Social uploads, DARF collections and ancillary reports are submitted.

5. Continuous Support

We provide ongoing compliance oversight, regular legal updates, and ensure all obligations remain accurately fulfilled.

Reliability

Benefits of Working With Us

Penalty-Free Operations

Stay ahead of fines and trigger-happy inspectors with real-time rule monitoring.

Transparent Costing

Clear simulations show the true burden of every hire before you sign a contract.

Deadline Assurance

Automated calendars ensure SPED, DCTF-Web and EFD-Reinf events never slip.

Actionable Insights

Understand workforce distribution, optimize hiring decisions, and plan payroll budgets with confidence.

Transparent Steps to Peace of Mind

How We Take You From Risk to Compliance

Step 01

Kickoff Session

Gather legal entities, benefit policies and collective bargaining data in one call.

Step 02

Data Migration

Securely import historical payslips and tax certificates into our platform.

Step 03

Parallel Run

Compare our calculations with your legacy outputs to validate accuracy.

Step 04

Go-Live & Review

Live filings commence and quarterly audits confirm continuous compliance.

ABOUT US

Why Companies Trust Wide Brazil

Since day one we have turned chaotic tax rules into smooth routines for international businesses entering Brazil.

10

YEARS OF OPERATION

Consistent delivery without a single late filing notice.

Testimonials

Graça BullaraHR Manager, AverisPartnering with Wide Brazil has been instrumental in launching our operations in Brazil. Their unparalleled services, considered the best in the country, have enabled us to swiftly onboard new staff. The lightning-fast and comprehensive support they provide has ensured a seamless transition, empowering our success in hiring and expanding. A decision we celebrate every day!

Thomás Della TorreGlobal Recruiter, Blue PremiumWorking with Wide Brazil has been a game-changer for our recruitment agency. Their exceptional services, by far the best in Brazil, come at a great price. We're thrilled by their lightning-fast onboarding process and unparalleled support, which have truly elevated our recruitment efforts. A partnership that's redefined our standards!

Confidential ClientGlobal EOR FirmOpting for Wide Brazil proved instrumental in our global EOR endeavors. Their exceptional services streamlined the onboarding of our new workforce in Brazil, while their unwavering support made navigating complex regulations remarkably straightforward. The team’s dedication and expertise transformed our expansion into the Brazilian market into a remarkably hassle-free experience!

Payroll Outsourcing

Delegate end-to-end payroll processing and let us shoulder every statutory duty.

Read MoreRegulatory Compliance

Holistic audits and monitoring ensure your entity meets evolving federal mandates.

Read MoreBusiness Process Outsourcing

Streamline auxiliary finance and HR tasks so you can focus on growth.

Read MoreCorporate Outsourcing

Combine accounting, tax and secretarial services under one secure roof.

Read MoreComplete Your Expansion Toolkit

Explore More Services That Keep You Compliant

Our multidisciplinary professionals combine payroll, labor, and corporate expertise to secure every aspect of your Brazilian operation.

Still Puzzled?

Tax classifications

- Tax classifications

- Withholding rates

- Ancillary obligations

Which payroll taxes trigger monthly filings?

INSS, FGTS and IRRF require monthly collection plus e-Social events; PIS and other social contributions are consolidated in EFD-Reinf.

Do benefits alter withholding calculations?

Yes. Meal vouchers, transportation aid and bonuses each have specific exemption limits that change the taxable base.

How long does initial compliance setup take?

Typical onboarding lasts 30 days, including parallel runs and credentials activation in federal portals.

Can you support multiple CNPJs?

Absolutely. Our platform accommodates unlimited entities and consolidates reports for group-level visibility.

Recent Posts

Nunc id cursus metus aliquam. Aliquam id diam maecenas ultricies mi eget mauris. Volutpat ac tincidunt vitae.

u003ci class='a-icon-heart'u003eu003c/iu003e 0 Like Post

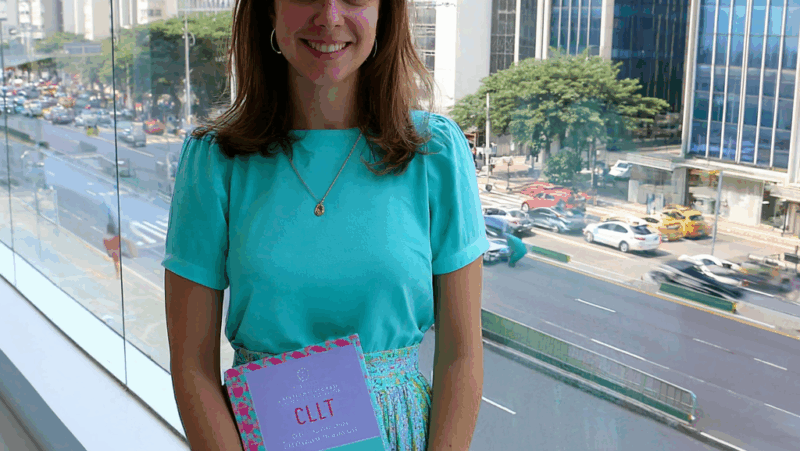

Brazilian employer compliance is one of the most daunting challenges faced by foreign founders and HR consultants seeking to establish or expand operations in Brazil. From the intricate Consolidação das…

Brazilian employer compliance is one of the most daunting challenges faced by foreign founders…